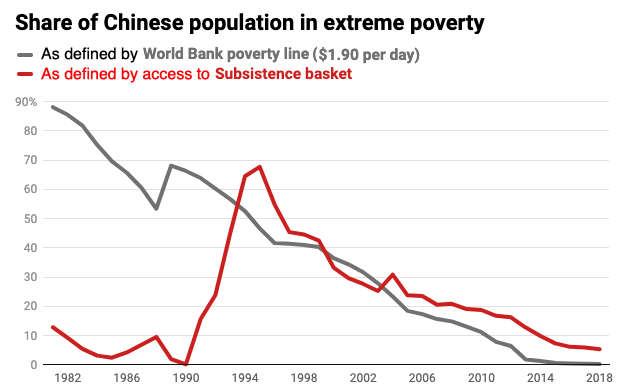

The economic growth and societal transformation under Stalin (in particular under his Five Year Plans from 1929-1955) registered the fastest growth in the history of humanity that has never been surpassed.

Not even China with all its achievements came close to what transformed the USSR from a poor feudal backwater of Europe into a space-faring nation within a single generation. And the USSR achieved all this while being isolated and without relying on cheap labor (workers rights were on par with Western European standards) and influx of foreign capital.

If you’re a Western capitalist, you’d be worried too. A country full of illiterate peasants and barely electrified, is now threatening to overtake us because of communism?

Khrushchev reversed much of Stalin’s policies that worked and marked the beginning of an end to the greatest socialist project of the 20th century.

Stalin’s Marxism and the National Question (~1913) was probably his best work.

Lenin loved it so much that he proclaimed it to be “the Bolshevik Party’s definitive declaration on the national question”.

Even Trotsky, his arch-nemesis, considered it a great work and had to throw in the jabs “hmm… why has Stalin never published another work of such quality before and after this? very suspicious… don’t you think… was it really written by Stalin himself??” lol.

Stalin’s Marxism and the National Question also became the theoretical foundation of the People’s Republic of China’s classification of its 56 ethnic nationalities, based on the criteria that Stalin had laid out.

Having said that, the Comintern did make a lot of mistakes when it comes to advising anti-colonial struggle in the third world. Mao’s theses were far more applicable to poorly developed colonies in this regard.