- cross-posted to:

- antiwork@lemmy.ml

513

- cross-posted to:

- antiwork@lemmy.ml

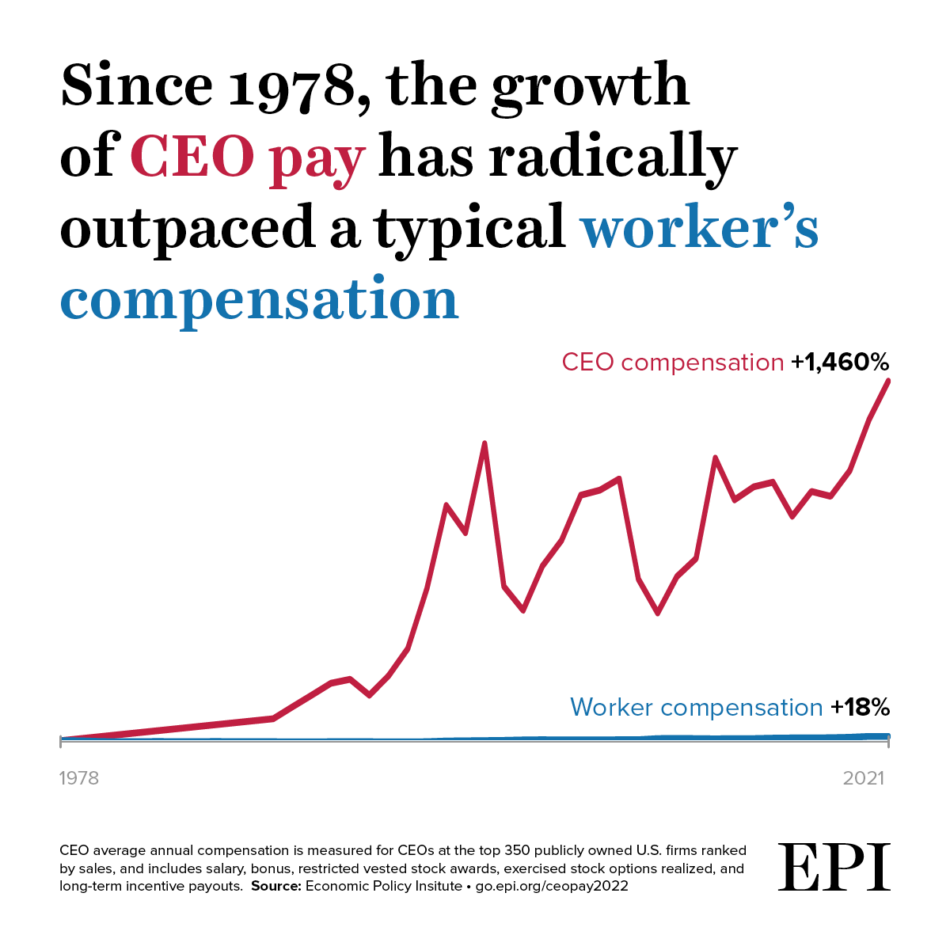

CEO pay has skyrocketed 1,460% since 1978: CEOs were paid 399 times as much as a typical worker in 2021

www.epi.orgWhat this report finds: Corporate boards running America’s largest public firms are giving top executives outsize compensation packages that have grown much faster than the stock market and the pay of typical workers, college graduates, and even the top 0.1%. In 2021, we project that a CEO at one of the top 350 firms in the U.S. was paid $27.8 million on average (using a “realized” measure of CEO pay that counts stock awards when vested and stock options when cashed in). This 11.1% increase from 2020 occurred because of rapid growth in vested stock awards. Using a different “granted” measure of CEO pay (which counts the value of stock awards and options when granted rather than realized), average top CEO compensation was $15.6 million in 2021, up 9.4% since 2020. In 2021, the ratio of CEO-to-typical-worker compensation was 399-to-1 under the realized measure of CEO pay; that is up from 366-to-1 in 2020 and a big increase from 20-to-1 in 1965 and 59-to-1 in 1989. CEOs are even making a lot more than other very high earners (wage earners in the top 0.1%)—almost seven times as much. From 1978 to 2021, CEO pay based on realized compensation grew by 1,460%, far outstripping S&P stock market growth (1,063%) and top 0.1% earnings growth (which was 85% between 1978 and 2021, according to the latest data available). In contrast, compensation of the typical worker grew by just 18.1% from 1978 to 2021.

Why it matters: Exorbitant CEO pay is a major contributor to rising inequality that we could restrain without doing any damage to the wider economy. CEOs are getting ever-higher pay over time because of their power to set pay and because so much of their pay (more than 80%) is stock-related. They are not getting higher pay because they are becoming more productive or are more skilled than other workers. This escalation of CEO compensation and of executive compensation more generally has fueled the growth of top 1% and top 0.1% incomes, leaving fewer of the gains of economic growth for ordinary workers and widening the gap between very high earners and the bottom 90%. The economy would suffer no harm if CEOs were paid less (or were taxed more).

How we can solve the problem: We need to enact policy solutions that would both reduce incentives for CEOs to extract economic concessions and limit their ability to do so. Such policies could include reinstating higher marginal income tax rates at the very top; setting corporate tax rates higher for firms that have higher ratios of CEO-to-worker compensation; using antitrust enforcement and regulation to restrain the excessive market power of firms—and by extension of CEOs; and allowing greater use of “say on pay,” which allows a firm’s shareholders to vote on top executives’ compensation.

“average top CEO compensation was $15.6 million in 2021, up 9.8% since 2020. In 2021, the ratio of CEO-to-typical-worker compensation was 399-to-1 under the realized measure of CEO pay; that is up from 366-to-1 in 2020 and a big increase from 20-to-1 in 1965 and 59-to-1 in 1989”

deleted by creator

A company that makes a 0$ profit and 0$ loss should be considered a successful one. Such a company would manage to pay all its costs (including wages, r&d, etc.) and function at peak efficiency.

I disagree. Some profit is good. It allows you to keep a coffer so you can keep afloat in bad years, as well as to buy back stocks for the employees. Once employee owned any profit can be voted on to either be added to budgets or distributed out amongst the employees.

Year over year growth is completely unsustainable. They should be content with making healthy profits in good times, and making any profit at all during times of recession.

This is the right answer.

Investors are primarily for M&A when brought on late.

Investors brought in early still deserve a day, because it is partially their company.

In the US there’s a legal obligation to the shareholders, it’s not just as simple as a sick owner culture trumpeting platitudes. To fix this problem we need to address both the culture and the legal frameworks: https://corpgov.law.harvard.edu/2019/02/11/towards-accountable-capitalism-remaking-corporate-law-through-stakeholder-governance/